April 2, 2024

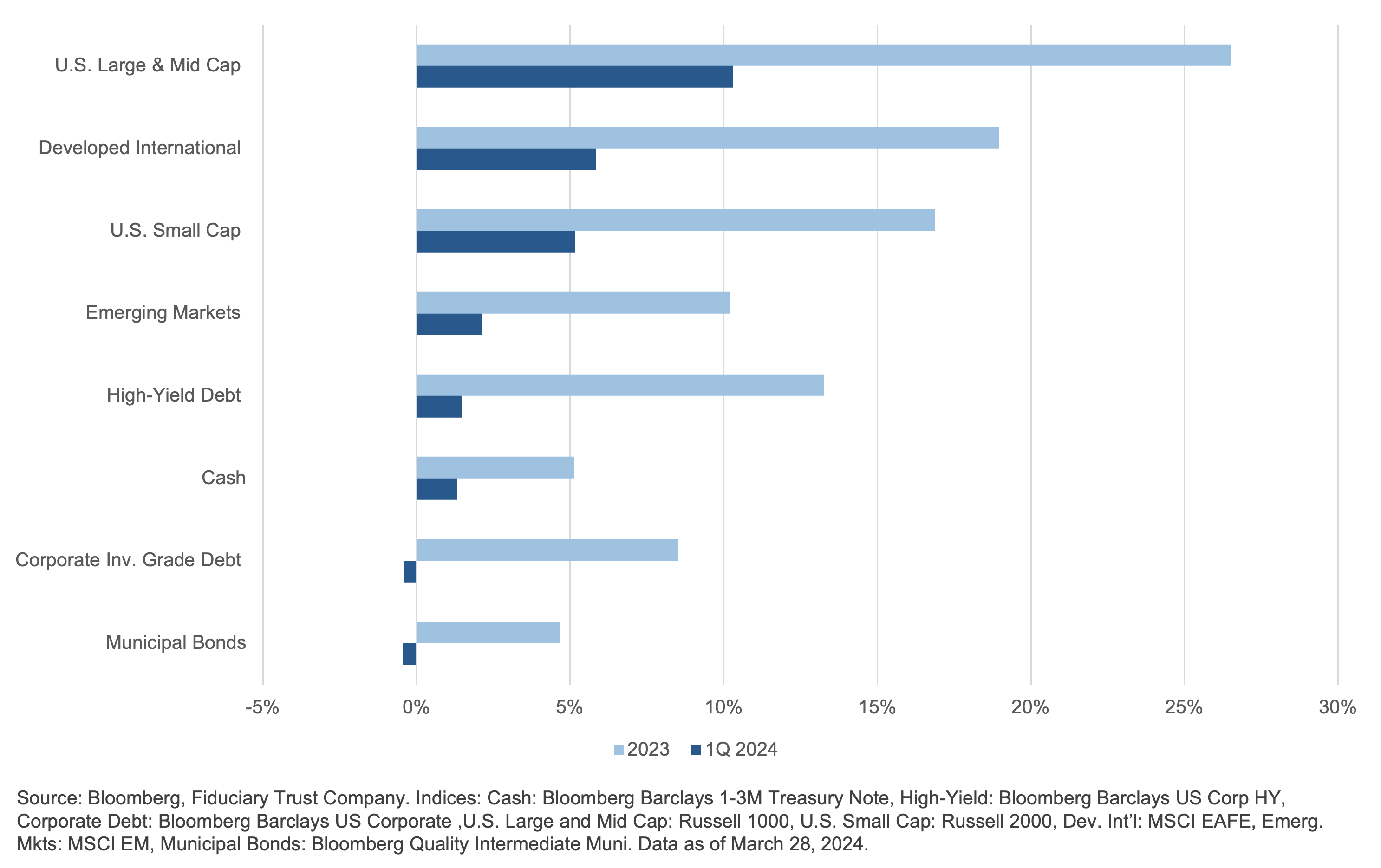

The investor cheer that closed out 2023 continues in good form this year. Stock returns across the globe remain hale and hearty despite a reset in anticipated interest rate cuts in the U.S., the end of yield curve control in Japan, and grinding wars in Europe and the Middle East (Exhibit A). Global equity prices are supported by economic growth. As the threat of recession remains a worry for another day, investors are focusing on whether the oft-mooted soft landing is finally taking place, bringing with it the lower interest rates that are expected to follow.

Exhibit A: Total Returns by Asset Class

Remarkably, equity markets seemed to shrug off the significant change in expected interest rate cuts this year. We wrote last quarter in our paper “2024 Market Outlook: What If There is No Landing?” about the significant disconnect between investors and the members of the Federal Open Market Committee. The former expected roughly six rate cuts, while the latter expected three. The gulf between the two had to be reconciled either by the Fed meeting the market expectations or market expectations moving to the Fed’s position. It seems that the market has capitulated, as market-based measures of rate cuts this year have halved to three.1 Oddly, investors are betting with high certainty of a rate cut in September. Weeks before the general election, a rate cut could be interpreted as the central bank placing a thumb on the election scale. Central bankers, while never far, try to stay away from politics and for good reason. There is no upside and considerable institutional downside for the central bank in the realm of partisan intrigue. From our perch, a cut in the months before the election is remote. June and November seem good bets for a cut absent any exogenous shocks.

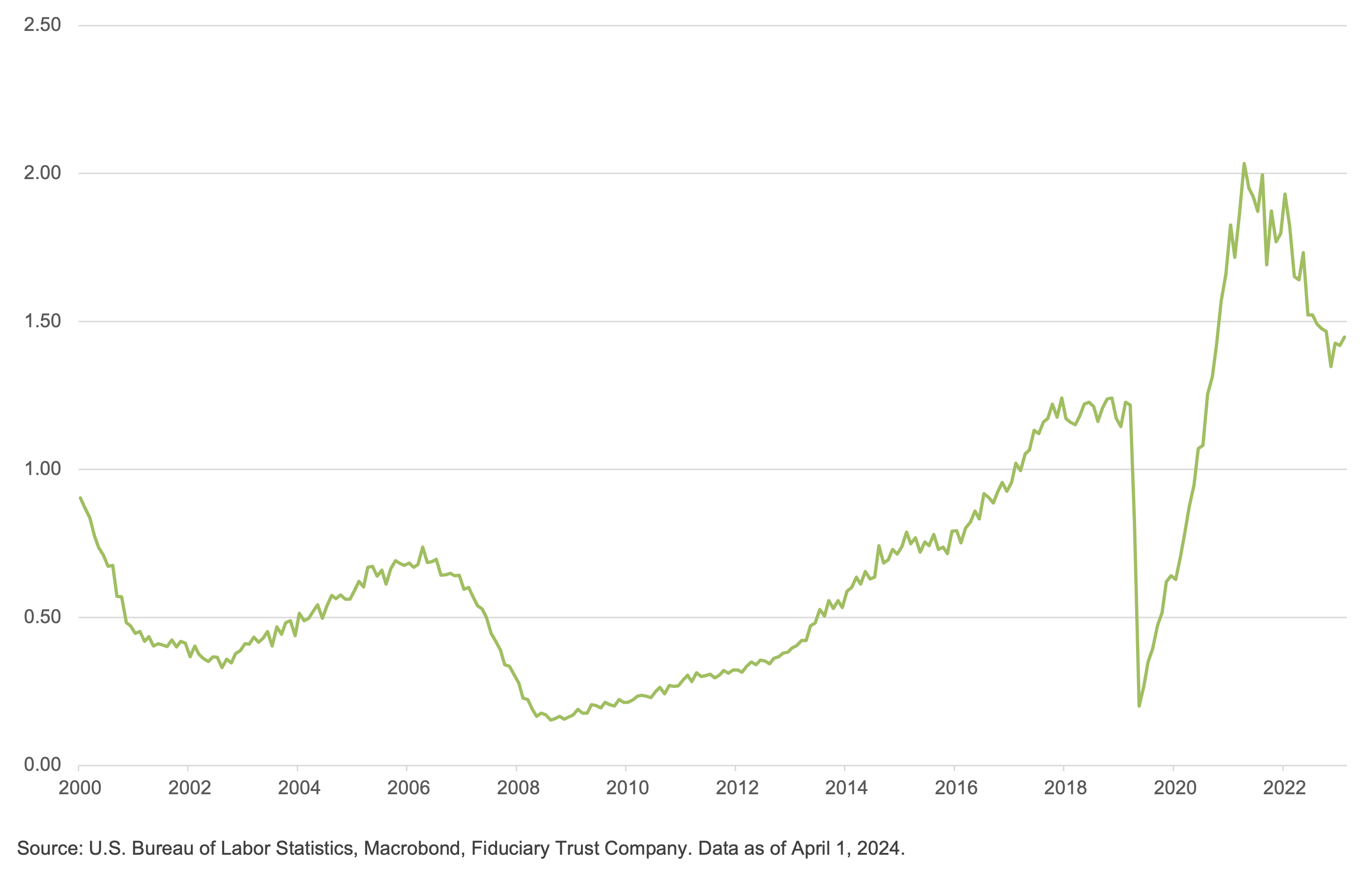

It may be that investors are unbothered by fewer interest rate cuts than expected as they apparently are not needed. Employment remains in fine fettle, as evidenced by monthly job gains. While labor shortages appear to be abating, they continue as roughly 1.4 jobs are available per unemployed worker (Exhibit B). Retail sales appear fine, as do wages, which continue to grow more than 4% over the prior year — above pre-pandemic levels. Most importantly for investors, profits are expected to continue to grow, rising 3.4% in the first quarter and 10.9% for the calendar year.2 A resumption of profit growth in 2024 will be viewed as confirmation that a recession this year is remote. Assisting all of this is the fact that financial conditions, as measured by a collection of indexes for money, equity, and bond markets, reveal accommodative conditions despite short-term interest rates of roughly 5.3%.3

Exhibit B: U.S. Job Openings Per Unemployed Person

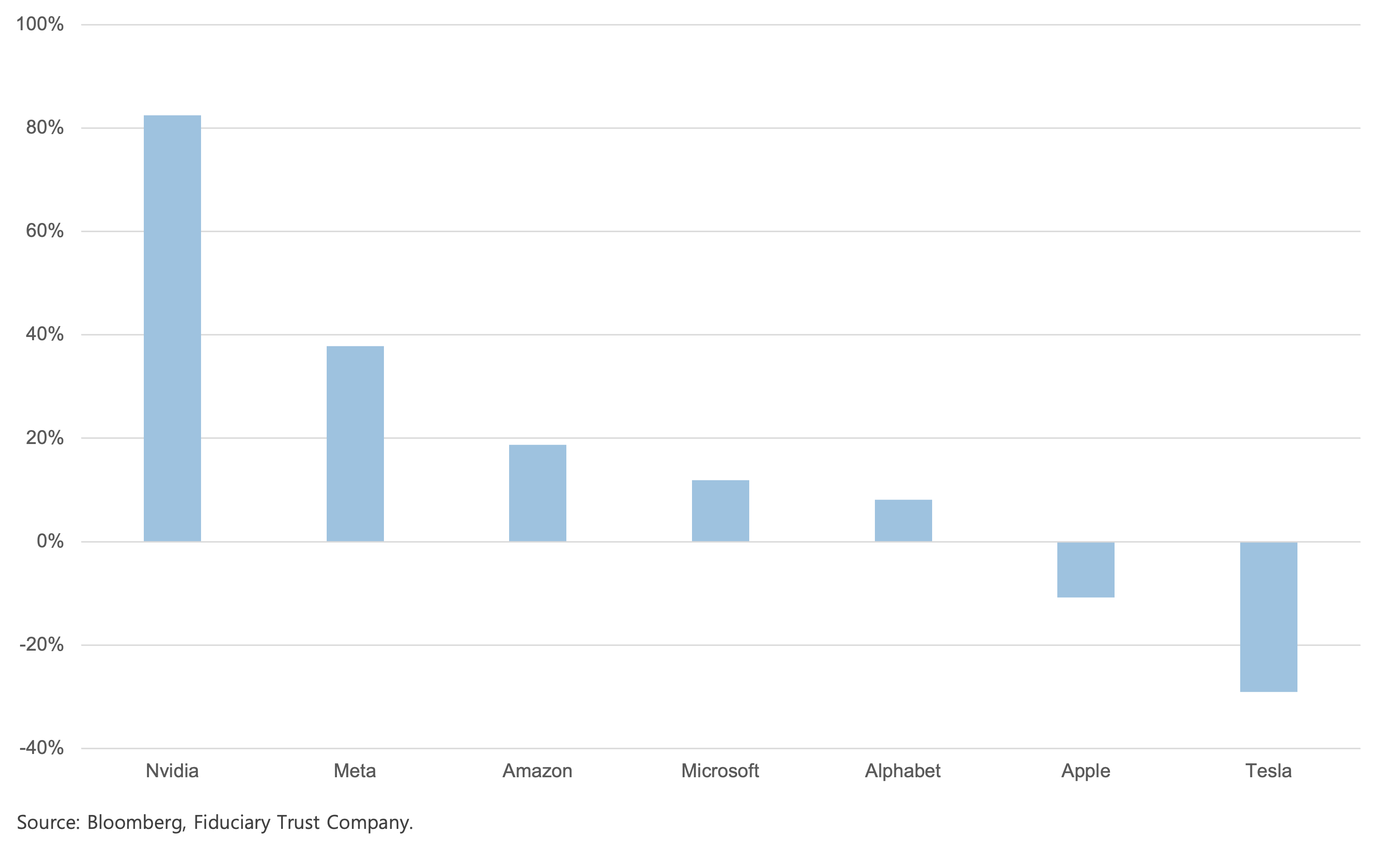

The Magnificent Seven Minus Two Plus the Top 10%

As we forecasted in our “2024 Market Outlook” last quarter, the Magnificent Seven’s performance is beginning to fracture (Exhibit C). This appeared to be inevitable as company-specific challenges at Apple and Tesla would overwhelm any AI-associated benefit. The importance of this collective of stocks in both returns and investor psyche over the last year is hard to overstate.

Exhibit C: Magnificent 7 Price Return, Q1 2024

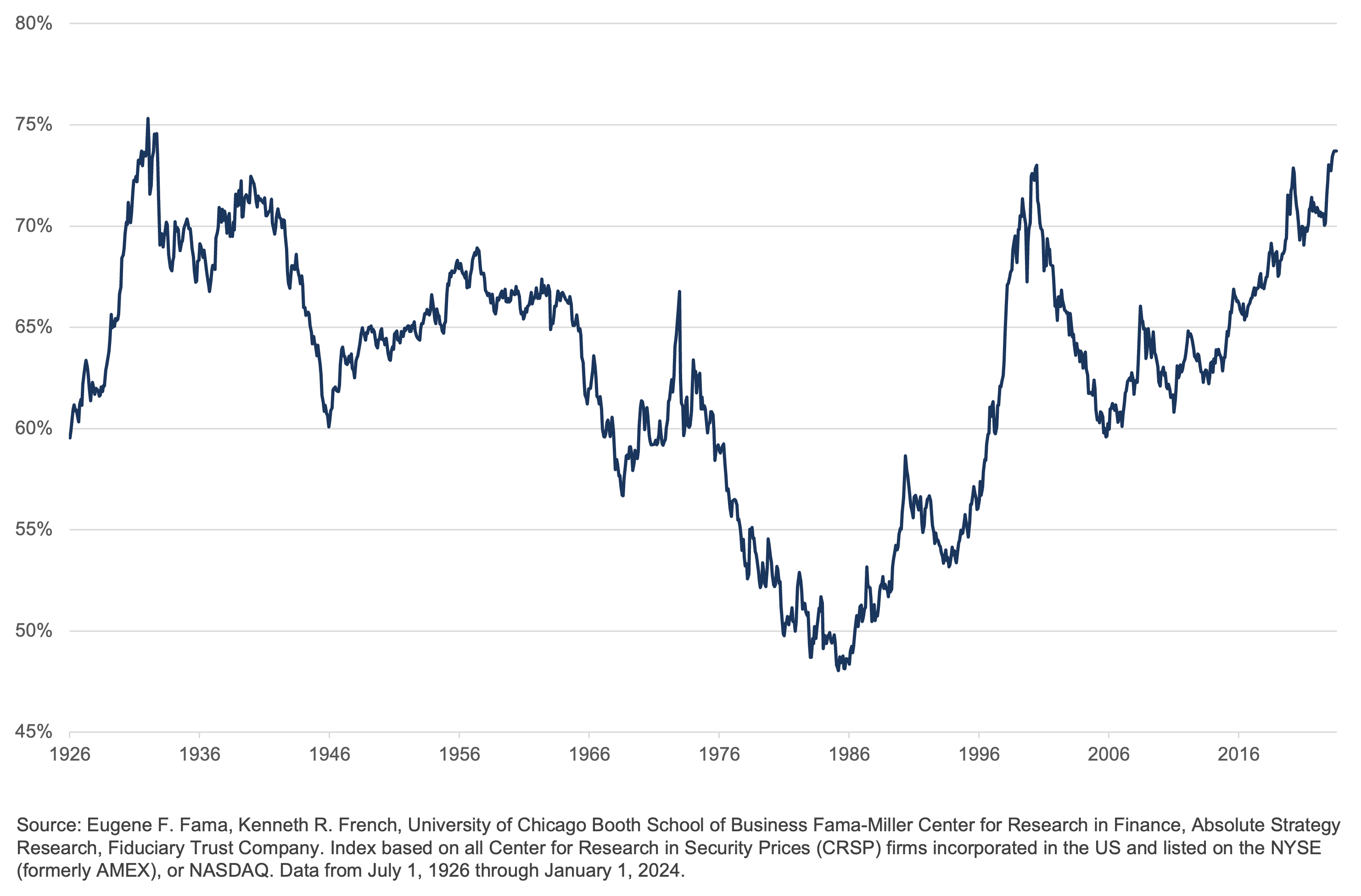

The market concentration in the large-capitalization segment of the U.S. market is impossible to ignore or view benignly. An analysis done by Absolute Strategy Research reveals that the percentage of the index made up by the top 10% of its members is at nearly a 100-year high (Exhibit D). Extreme market concentration tends to set teeth on edge, as it is historically unsustainable. If economic growth continues and earnings are delivered as expected, it is reasonable to expect a broadening of the bull market and thus a welcome reduction in market top heaviness.

Exhibit D: Proportion of Market Represented by the Top 10% of Stocks by Market Value

Peering Over the Horizon

With the economy performing well and the market leaping into the year with robust returns, some of the returns we expected over the course of the year were pulled forward into the first quarter. Consequently, we anticipate a period of sideways movement in prices while the profits investors expect are delivered by companies. In short, a repeat of the first quarter’s performance during the second is not a solid bet.

The timing and number of interest rate cuts this year remain a wild card. Investors were extremely optimistic about their forecast of the number of cuts the central bank would deliver this year, especially during an election year, when any action tends to be seen through a partisan lens. With seven months remaining until Election Day, four meetings scheduled before November 5th, and a likely multi-month embargo of rate action if the Federal Reserve wants to avoid the appearance of scale tipping, there are only three meetings in which rates could realistically be cut. As a result, any rate action(s) will likely be split between one or two cuts through June and the balance later in the autumn. Should events play out as we expect, bouts of market disturbance are likely as reality collides with expectations.

The AI theme that has been at the forefront of investor attention and returns appears to have legs to run. Profits for companies active in the space continue to show solid-to-impressive growth. This theme is all about transformation, productivity, and profits. Nvidia, Microsoft, and Alphabet continue to lead in the sector. We own these companies in multiple forms through ETFs.

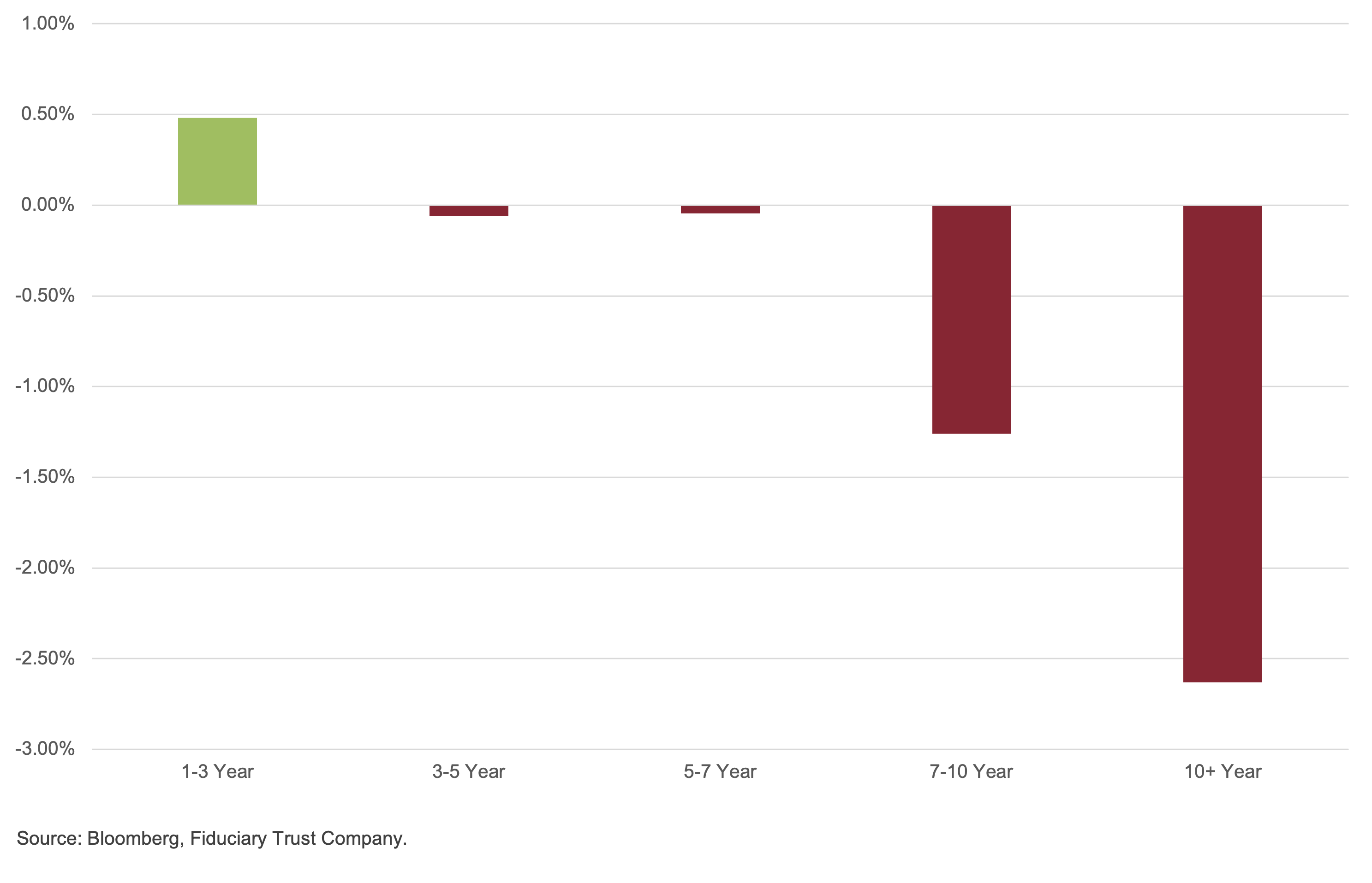

At the beginning of the year, consensus held firmly that investors should extend fixed income duration ahead of the rate cuts that were certain to follow. We were skeptical given the gulf between what the market was proposing and what the central bank was likely to dispose. We therefore recommended that fixed income durations be kept on the shorter side. This departure from the crowd view has been vindicated as the only section of the yield curve to produce a positive return was the one- to three-year segment. All other maturity buckets fell during the quarter (Exhibit E). This dynamic may well continue into the second and third quarters as the calendar works against more cuts ahead of the election.

Exhibit E: Total Return of U.S. Treasuries by Maturity, Q1 2024

Finally, now that the races for the Republican and Democrat nominees for president have been decided, election season begins. This one has the promise to continue the pattern we’ve seen over the past two election cycles. The bevy of proposals, well-grounded as well as extreme, that will likely be floated during the campaigns have questionable probability of coming to fruition and therefore should be heavily discounted. Investors should look through the election season before judging how policy will impact profits, as wholesale changes in the legislative and executive section of government are quite possible this year.

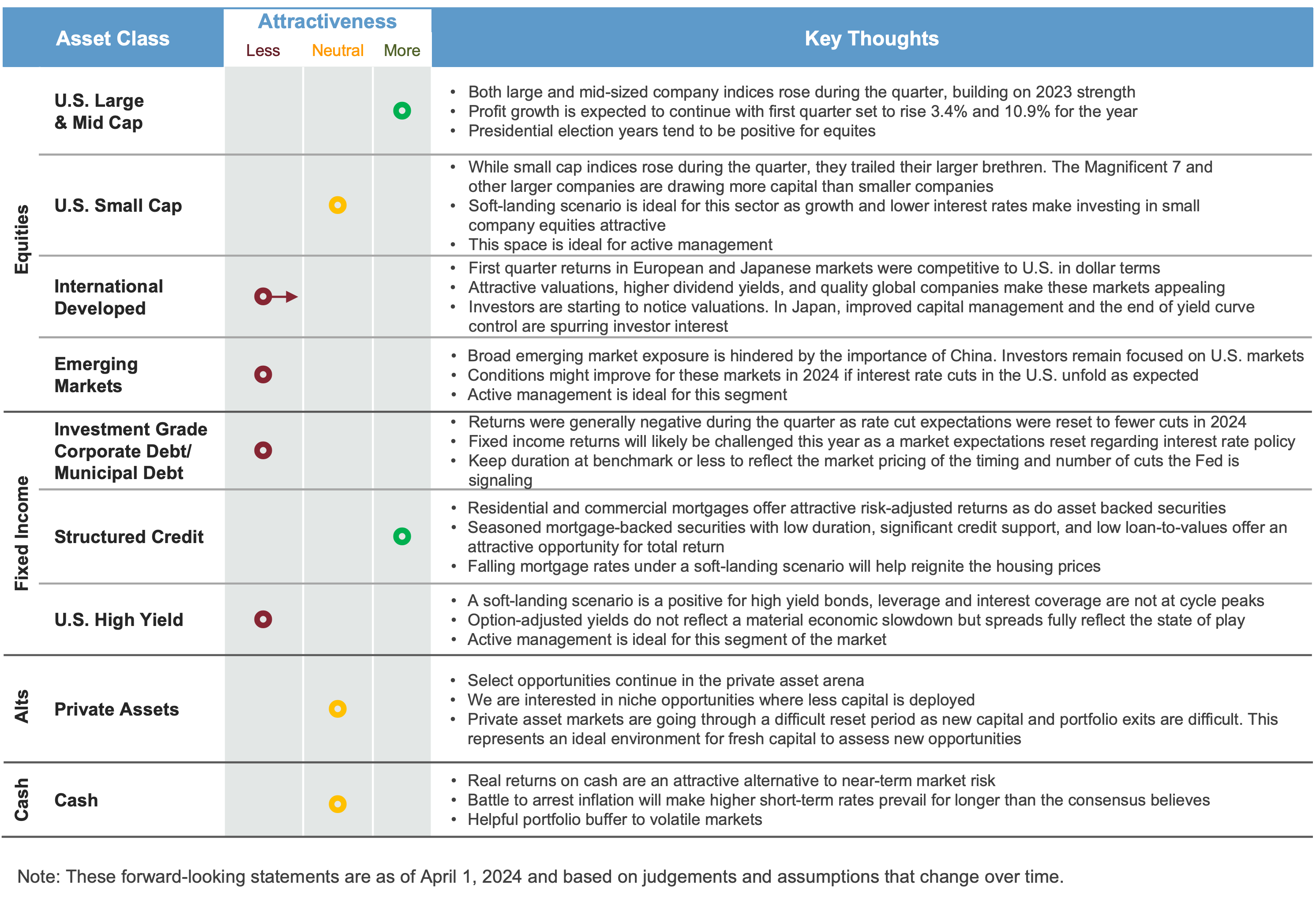

Exhibit F: Fiduciary Trust’s Asset Class Perspectives

1 Data from Bloomberg based on Federal Funds Futures as of March 27, 2024.

2 Earnings data from Factset Earnings Insight, March 21, 2024.

3 Financial Conditions Index via Bloomberg as of March 21, 2024, and short-term interest rates measured by effective Federal Funds Rate as of March 21, 2024.

Here is a link to our Fiduciary Perspective, which includes a copy of the Market Outlook”.

Disclosure related to Bloomberg indices: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.