The COVID-19 pandemic has created dislocation in the markets. In addition, interest rates are at very low levels, with the Federal Reserve recently decreasing the Federal Funds target rate back to the lowest levels on record. While these economic circumstances present a challenge for many, there are several wealth transfer techniques that are particularly well suited to taking advantage of this low interest rate and depressed market value environment. Lifetime gifting, grantor retained annuity trusts, and intra-family loans are a few of these techniques.

Lifetime Gifting

For individuals who have sufficient wealth to consider lifetime gifting, low valuations present a good opportunity to make gifts of marketable securities that will appreciate over time. Gifts can be made outright or, when passing wealth onto children and grandchildren, gifting can also be accomplished with a trust. Trusts will allow the grantor to keep some control over money that is being gifted.

The federal gift tax applies to transfers of property by gift. The general rule is that any gift is a taxable gift. However, there are a number of exceptions to this rule, including gifts that are valued at less than the annual exclusion amount, which is $15,000 for 2020. As a result, an individual may gift $15,000 to any number of persons without incurring any gift tax; married couples may transfer $30,000 to any number of persons without incurring any gift tax.

In addition, the Tax Cuts and Jobs Act of 2017 expanded the federal estate and gift tax exemption. For 2020, that exemption is $11,580,000 per person, or $23,160,000 for a married couple. There has been a focus on using the expanded federal and gift tax exemption given that the higher exemption amount is scheduled to sunset on December 31, 2025. On January 1, 2026, the exemption returns to $5 million per person, adjusted for inflation. The current increased exemption amount presents a significant but temporary opportunity for tax-free wealth transfer, and recent declines in asset valuations heighten this opportunity. Assets are valued at the time of the gift, and low market valuations may enable individuals to transfer assets that may have a greater intrinsic worth than their current market value. While the transfer of depressed value assets may serve to leverage the benefit of giving, if the asset value is so depressed that it is less than the donor’s cost basis, it may not be wise to transfer such an asset. The loss inherent in such an asset cannot be fully realized.

Grantor Retained Annuity Trusts

Grantor retained annuity trusts (commonly referred to as GRATs) are particularly well suited for an environment with low interest rates and low valuations. A GRAT is an irrevocable trust into which the grantor contributes assets while retaining the right to receive a fixed dollar amount from the trust each year for a fixed period of time (the trust term). At the end of the trust term, the remaining assets are transferred outright to or retained in trust for the named beneficiaries. A GRAT works well if the assets transferred to the GRAT ultimately appreciate during the GRAT term at a rate higher than the Internal Revenue Service’s (IRS) Section 7520 interest rate in effect when the GRAT is funded. If market valuations of assets transferred to a GRAT are low and expected to appreciate, this can be a very effective vehicle for transferring wealth.

While the transfer of the assets to the GRAT constitutes a “gift” for federal tax purposes, the value of the gift can be offset by the value of the grantor’s retained annuity interest. The value of the gift is determined by subtracting the value of the retained annuity interest from the value of the property transferred. The gift of the remainder is a gift of a future interest, and the annual gift tax exclusion amount cannot be applied. However, the grantor can utilize the current $11,580,000 lifetime federal estate and gift tax exemption towards the amount of the gift. GRATs can also be zeroed-out so that there is no gift. A zeroed-out GRAT is one where the present value of the annuity payments over the term of the trust equals the projected value of the trust when it terminates.

The value of the grantor’s retained interest is determined by the IRS prescribed interest rate found in Internal Revenue Code (IRC) Section 7520. The Section 7520 rate is used to determine the grantor’s present value in the annuity. The lower the Section 7520 rate, the greater the computed value of the retained interest. The Section 7520 rate is linked to U.S. Treasury notes with maturities of between three and nine years and is calculated monthly by the IRS. A GRAT is a particularly attractive wealth transfer technique right now because the Section 7520 rate is currently a low 0.6%.1

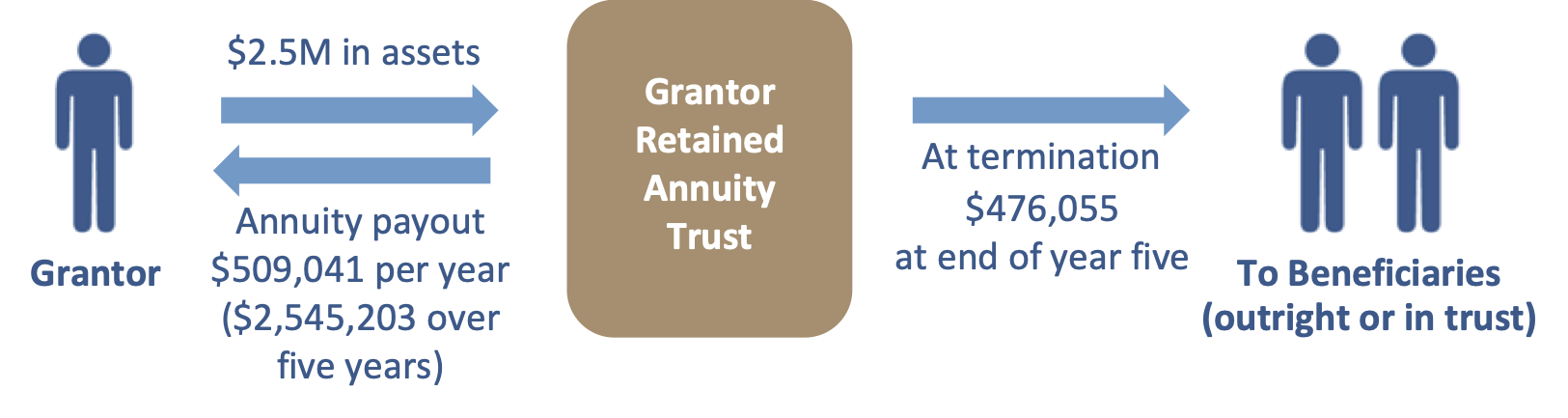

Here is an example: Suppose you are 55 years old and transfer $2,500,000 into a 5-year zeroed-out GRAT. If the assets appreciate at a rate of 6% per year, in five years $476,055 could pass to your named beneficiaries or to a trust for your named beneficiaries free of gift taxes, and without using any of your federal estate and gift tax exclusion. Over the five years, you would receive a total of $2,545,203 ($509,041 per year).

As noted above, a GRAT succeeds if the trust assets appreciate more than the Section 7520 rate. Any appreciation generated over the term of the GRAT above the Section 7520 rate is transferred tax free. The higher the appreciation, the greater the impact, and the greater the opportunity to reduce your taxable estate and make tax-efficient transfers to your beneficiaries. The fact that there are many undervalued assets at this time with which to fund a GRAT makes this an especially opportune time to consider GRATs as a wealth transfer technique.

One point to note is that to receive the benefits of the GRAT, the grantor must survive the trust term. If the grantor does not survive the term, the trust assets are included in the grantor’s estate and subject to estate taxes. However, if the grantor did not utilize any lifetime federal estate and gift tax exemption or pay any gift taxes when the trust was established, there is no negative tax effect of an unsuccessful GRAT. The grantor will incur set up and administration costs, but these costs can be relatively low depending on the type of funding assets. Because the GRAT is a grantor trust for income tax purposes, income and capital gains generated by the GRAT assets are taxable to the grantor during the term. GRATs are not well suited to utilize generation skipping tax exemption; therefore, they are not used to transfer assets to grandchildren.

Intra-Family Loans

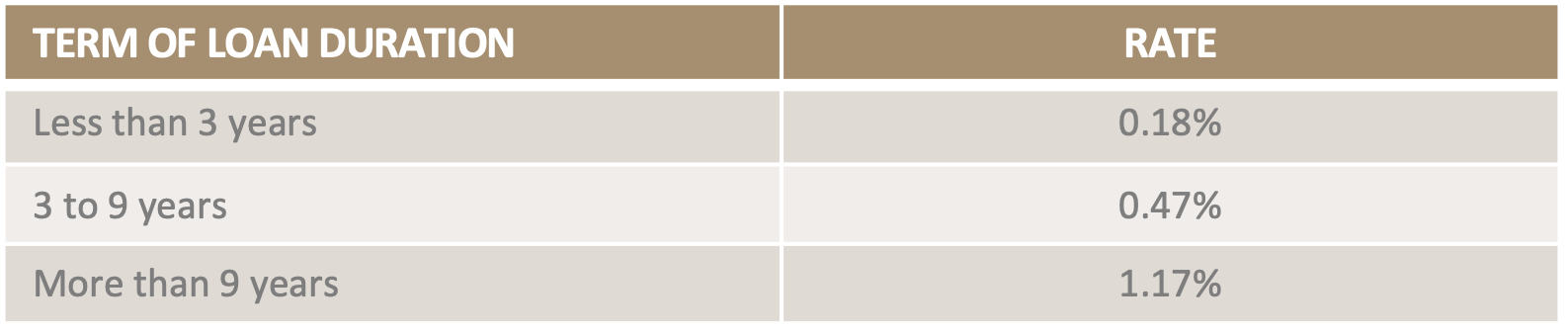

Intra-family loans are another wealth transfer technique that can be very effective in a low interest rate environment. The IRS prescribed interest rates for intra-family loans are set forth in IRC Section 1274(d). The IRC 1274(d) rates for July 2020, with annual compounding, are as follows:

Given the low interest rates, if cash is available an opportunity exists in appropriate circumstances for parents or grandparents to lend funds to a member of a younger generation at very low interest rates. While intra-family loans are frequently used to fund the purchase of a home, the proceeds of such a loan can be used for any purpose, including investment. If the rate of return on the investments is higher than the specified rate stated on the promissory note, assets can effectively be transferred tax free.

Intra-family loans must be structured as an arm’s length transaction. There must be a written loan agreement executed prior to the transfer of any funds, and the loan agreement must set, at a minimum, the prescribed Section 1274(d) rate for the loan term. The loan payments must be made or the loan may later be re- characterized as a disguised gift. Such a re-characterization could result in gift and generation skipping tax consequences (and potentially interest and penalties). It is also important to note that if the child or grandchild invests the funds and the assets underperform the interest rate for the loan, the borrower may have to use other assets to repay the loan.

Fiduciary Trust is experienced in helping clients plan for and utilize these tax-efficient wealth transfer techniques. Please reach out to a Fiduciary Trust officer if you would like to discuss how these approaches could benefit your family.

Published July 2020

1Rate for July 2020

Click here to view the pdf version of this article.